You can donate to a cause or charity on your own. But when you entrust The Denver Children’s Foundation (DCF) with stewardship of your Legacy Grant donation, you invest in an exhaustive charity review process to select the best of the best . . . and you help build our community’s next generation of philanthropic, business, and social leaders.

With a minimum annual donation of $10,000 for a 3-year term, you receive recognition with a named grant and publicity through our social network and events, select the charity to receive your grant from our approved grant applicant slate and, if you pay taxes in Colorado, you’ll benefit from an additional Colorado Child Care Contribution (CCCC) Tax Credit.

Want to start smaller? We’ll provide a CCCC Tax Credit for EVERY donation of $1,000 or more.

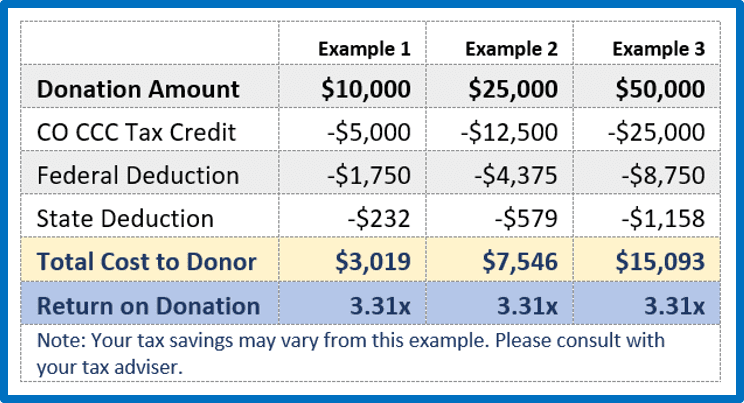

Colorado’s donor-friendly Colorado Child Care Contribution (CCC) tax credit means your donation dollars produce a return of 3.3x after credits and deductions; the examples below assume a 35% federal tax rate and 4.63% Colorado tax rate. Learn more with this short video.

Roxanne May Grant for Adoptive Children

Joy Dinsdale Grant for Children in the Arts

LEGACY DONORS

Ryan Arnold Family (outdoor education) – 2021-2026

Baceline Investments Gives (child advocacy) – 2021-2023

Chris and Joy Dinsdale Family (arts and culture) – 2019-2021

Jason White / White Out Consulting (outdoor education) – 2020-2021

Karen and Charles Farver Family (hunger and wellness) – 2020-2022

Zach and Roxanne May Family (adoption and fostering) – 2019-2021

Stefan Morton / Morton Family (educational opportunities) – 2021-2025

Sunrise Youth Fund (after-school programs) – 2024

Matt & Mark Ward / Ward Electric (children with special needs) – 2021-2023

Kane Kunz (arts and trades) – 2022-2024